Security Benefit Finds RIA Confidence Slipping as Market Uncertainty Builds

Security Benefit Finds RIA Confidence Slipping as Market Uncertainty Builds

Few advisors expect a recession in 2026, and over half see a positive economic impact from the Trump administration, but 50% now forecast higher levels of stock market volatility

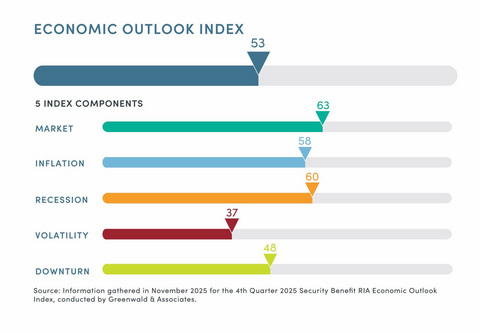

TOPEKA, Kan.--(BUSINESS WIRE)--Registered investment advisors (RIAs) are growing more cautious as their economic outlook for 2026 shifts, according to the latest RIA Economic Outlook Index released today by Security Benefit in partnership with Greenwald Research. The index, which measures advisor sentiment on a scale from 0 (extremely pessimistic) to 100 (extremely optimistic), fell to 53 in the fourth quarter, marking the lowest reading since the index was introduced in Q1 of 2024 and signaling a continued cooling in confidence.

“Advisors are clearly recalibrating expectations as they head into 2026, but this isn’t a retreat from the market,” said Mike Reidy, National Sales Manager, RIA Channel at Security Benefit. “RIAs are balancing heightened volatility concerns with disciplined portfolio strategies, staying focused on long-term goals while helping clients navigate a more uncertain environment.”

Inflation Expectations Weigh on Advisor Sentiment

Inflation expectations were a key driver of the decline, with fewer advisors confident price pressures will remain contained over the next year, despite U.S. inflation hovering at 2.7% according to the latest Personal Consumption Expenditures (PCE) Price Index1 released today. The unemployment rate also climbed to 4.6% in November, according to the Bureau of Labor Statistics2, adding to the uncertainty around the broader economic outlook. Just four in ten (42%) of RIAs now expect inflation to remain below 3% in twelve months, down sharply from seven in ten (69%) last quarter.

Market volatility concerns also increased in the fourth quarter, even as recession expectations remained relatively contained. Half of RIAs (50%) now expect stock market volatility to be higher over the next 12 months than in 2024, up from 42% last quarter. At the same time, 23% of advisors say they are extremely or very concerned about the risk of a major equity market downturn, up from 16% in the third quarter, underscoring a growing focus on downside risk as advisors navigate a more uncertain market environment.

RIAs Express Mixed Views on Policy Impacts Heading Into 2026

As we approach the one-year anniversary of proposed tariffs, views on the policy environment are divided, reflecting another source of uncertainty shaping advisor sentiment. More than half of RIAs (54%) believe the Trump administration will have a positive impact on the U.S. economy in 2026, while one-third (33%) expect a negative impact, underscoring the lack of consensus around the economic implications of policy direction in the year ahead.

Concerns are more pronounced when advisors consider specific policy levers. Nearly half of RIAs (45%) expect trade and tariff policy to have a negative impact on equity markets over the next twelve months, compared with 26% who anticipate a positive effect. Another 29% see neither a positive or negative impact or are not sure. At the same time, views on the size of the federal debt remain more muted, with only 20% of advisors saying it is likely to negatively impact the economy in 2026—suggesting that near-term market and trade considerations are weighing more heavily on outlooks than longer-term fiscal issues.

From Outlook to Action: How RIAs Are Positioning for 2026

As advisors look ahead, many are adjusting portfolios to reflect a more uncertain environment without retreating from growth opportunities. A third of RIAs (34%) say they increased their allocation to international equities in the fourth quarter, suggesting greater emphasis on diversification as they manage volatility and shifting global dynamics.

At the same time, advisors remain selective in their use of defensive solutions. Just one in ten RIAs report increasing allocations to annuities with guaranteed lifetime income during the quarter, while nearly half (46%) say their primary business focus in the first half of 2026 will be deepening existing client relationships, significantly outpacing client acquisition (29%). Together, the findings point to a measured, client-centric approach as RIAs balance caution with long-term objectives.

Methodology

In November 2025, Greenwald Research surveyed 100 registered investment advisors from across the United States, each managing significant assets and directly interacting with clients. The online questionnaire collected crucial data on RIAs’ business practices, economic outlook, financial product usage, and client demographics. This method blended quantitative and qualitative insights, capturing key trends within the financial advisory industry.

About Security Benefit

SBL Holdings, Inc. (“Security Benefit”), through its subsidiary Security Benefit Life Insurance Company (SBLIC), a Kansas-domiciled insurance company that has been in business for 133 years, is a leader in the U.S. retirement market. As of September 30, 2025, Security Benefit had $59.5 billion in assets under management, and together with its affiliates offers solutions across a range of retirement markets and wealth segments. Security Benefit, an Eldridge Industries business, continues its mission of helping Americans To and Through Retirement®. Learn more at www.securitybenefit.com and follow us on LinkedIn, Facebook, and X.

About Greenwald Research

Greenwald Research is a leading independent research and consulting partner to the health and wealth industries that applies quantitative and qualitative research methods to produce insights that help companies stay competitive and navigate industry change. Leveraging deep subject matter expertise and a trusted consultative approach since 1985, Greenwald offers comprehensive services to answer strategic business questions.

SB-10076-15

FINANCIAL PROFESSIONAL USE ONLY - NOT FOR USE WITH CONSUMERS

Annuities are issued by SBLIC in all states except New York.

| ___________________________ | |

Contacts

Media

Security Benefit, media@securitybenefit.com