Americans Are Rethinking Risk in the Face of Extreme Weather and Economic Uncertainty—and so Are the Organizations That Serve Them

Americans Are Rethinking Risk in the Face of Extreme Weather and Economic Uncertainty—and so Are the Organizations That Serve Them

New research from Church Mutual® sheds light on shifting mindsets that have implications for nonprofits, schools and faith-based organizations

MERRILL, Wis.--(BUSINESS WIRE)--From unpredictable storms to economic strain, Americans face a growing list of challenges—and they’re responding by taking a closer look at how well they’re protected. This mind shift has implications far beyond individual households.

This growing attentiveness to insurance is a key signal for decision-makers at houses of worship, schools, camps and nonprofits and an encouraging sign that conversations about risk and readiness are no longer limited to insurance experts.

Share

In its latest national survey, Risk Radar Report—Insurance Pulse Check1, Church Mutual Insurance Company, S.I. (a stock insurer)2 finds 63% of U.S. adults have reviewed their property coverage in the past six months. This growing attentiveness to insurance is a key signal for decision-makers at houses of worship, schools, camps and nonprofits and an encouraging sign that conversations about risk and readiness are no longer limited to insurance experts. People are paying attention, and they’re taking action.

“People are thinking beyond just having insurance,” said Jeff Zehr, senior vice president – Underwriting, admitted business, at Church Mutual. “They want to understand what their policies actually cover, how to reduce their exposure and how to prepare for the next big storm—or whatever comes next.”

Generational shift: A new kind of risk literacy

While Baby Boomers were most likely to say they understand their policies “extremely well” (55%), Millennials and Gen X weren’t far behind at 53% and 52%, respectively. Even Gen Z is getting in the game, as 63% say they’re proactively seeking information to protect their property.

That interest comes with a sense of confidence; 60% of respondents overall say they feel adequately covered by their current insurance policies.

Severe weather is changing the conversation

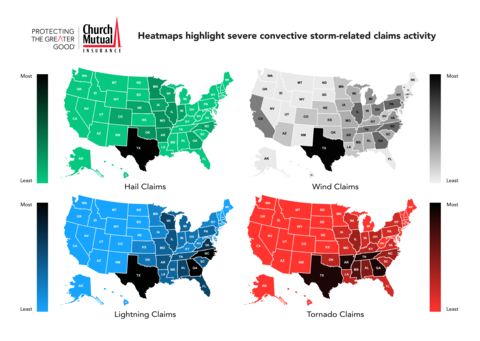

Half of Americans believe they live in a part of the country where severe weather is a real concern. But as wildfires, hurricanes and other disasters grow more frequent and severe, the risks may be expanding beyond traditional zones. In fact, severe convective storm heatmaps based on Church Mutual claims data indicate the “traditional” areas for different types of storm damage are moving.

These findings reflect growing concern among consumers about the long-term sustainability of property protection. One in three Americans worry that severe weather could significantly impact the affordability of insurance in the future.

A shift toward readiness

Consumers are paying closer attention to their coverage, but for many, actions are still triggered by disruption. Seventy-seven percent say they would research other property insurance options if their provider dropped or ended their coverage. More than half (56%) say they would explore ways to protect their property and avoid a loss.

“It’s encouraging to see more people engaging in risk mitigation,” Zehr said. “Not only can organizations do more, but there’s still work to be done to close the gap between what people think is covered and what’s actually protected in a claim scenario.”

While not always proactive, these shifts in mindset signal growing awareness. As more Americans face the realities of climate, cost and coverage, the pressure is on for insurers, policymakers and communities to adapt alongside them.

Looking ahead

With rising costs, a dynamic property insurance market and evolving weather patterns, these findings aren’t just relevant to individual consumers. They reflect the pressures the organizations that serve them will need to mitigate as well.

This latest pulse check offers a glimpse into how risk awareness is evolving nationwide and why schools, religious institutions, nonprofits and camps must continue adapting in response.

“We’re seeing more people take an active role in understanding their coverage,” Zehr said. “This gives us a chance to have better conversations during underwriting—ones that help ensure their organizations are protected in the ways that matter most.”

About Risk Radar Report

Insurance Pulse Check is the latest in Church Mutual’s Risk Radar initiative that provides proprietary, primary research to gather key, forward-looking insights for nonprofits, schools, camps and houses of worship, helping them maximize opportunities and minimize risk. Risk Radar Report – Insurance Pulse Check surveyed 1,030 U.S. adults (ages 18+). Heatmaps of storm-related claims activity are based on internal Church Mutual data collected between 2020 and early 2025.

About Church Mutual

Church Mutual Insurance Company, S.I., founded in 1897, offers specialized insurance for religious organizations of all denominations, public and private K-12 schools, colleges and universities, secular and non-secular camps and conference centers, and nonprofit and human services organizations throughout the United States. To learn more, visit churchmutual.com.

1 Church Mutual Insurance Company, S.I. conducted an online survey through Padilla, The Church Mutual Risk Radar Report – Insurance Pulse Check, in March 2025, with a nationally representative sample of 1,030 adults aged 18+. 2 Church Mutual is a stock insurer whose policyholders are members of the parent mutual holding company formed on 1/1/20. S.I. = a stock insurer. |

Contacts

Contact: Jennifer Johnson

Title: Senior Corporate Communications Specialist

Phone: (715) 539-5797

Email: jmjohnson@churchmutual.com