Study Finds Foreclosure and Recession Fears Point to Housing Slowdown

Study Finds Foreclosure and Recession Fears Point to Housing Slowdown

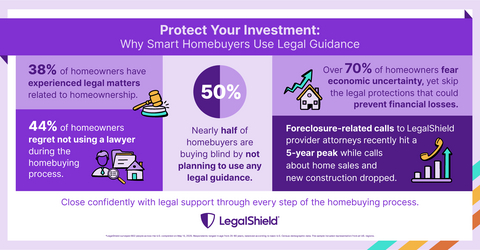

- Five-year high: Calls from homeowners to lawyers about foreclosure surge

- More than 70 percent of homeowners and buyers worry a recession and tariffs will derail homeownership plans

- 44 percent of homeowners regret not using a lawyer during the homebuying process to protect their asset

ADA, Okla.--(BUSINESS WIRE)--Legal requests related to foreclosures have reached their highest level in five years, coinciding with a new LegalShield survey showing that more than 70 percent of homeowners and prospective buyers worry that a potential recession and tariffs could disrupt their housing plans.

LegalShield also saw a marked drop in inquiries related to home purchases and housing construction, suggesting a potential slowdown in the overall housing market.

"The hard data from consumers calling lawyers matches their fears about the economy: their homes are at risk and things may get worse," said Warren Schlichting, LegalShield CEO. "The other concerning finding is a drop in consumers asking for help to buy a home and a decline in questions from builders."

Foreclosure Surge Reflects Mounting Economic Strain

Calls to LegalShield provider lawyers about foreclosures spiked in May to the highest level since April 2020.

"Our data highlights a convergence of pressures: buyers from the homebuying surge a few years ago want help with rising insurance premiums, property tax reassessments, and adjustable-rate mortgage resets," said Matt Layton, senior vice president of consumer analytics. "People are reaching out to LegalShield provider lawyers to save their homes, and they're scared of the next shoe to drop in the economy."

Signs of the Times: Home Sales and Construction Inquiries Sink

In a potential sign of a coming slowdown in housing transactions and construction, LegalShield saw significant declines in inquiries about buying and selling existing homes and home building.

LegalShield fields approximately 150,000 calls monthly from consumers nationwide covering more than 90 areas of law, including real estate-related issues.

In May, legal activity related to housing sales fell to its lowest level since July 2023, the last time the Federal Reserve raised interest rates. Both buyers and sellers face mounting friction amid affordability challenges due to mortgage rate uncertainty, elevated home prices and inventory challenges.

LegalShield's Housing Construction Index, which tracks closely with Housing Starts reported by the U.S. Census Bureau, is now at its lowest level since March 2020 and down 4.1% this year suggesting a potential slowdown in new home building.

Legal Problems Driving Buyers Away

The nationwide survey, conducted in May, found that over a third of current homeowners (38%) experience costly legal issues related to their property, and 30% of all respondents have walked away from buying a home due to preventable legal problems. Homeowners say they regret not consulting an attorney in their homebuying process (44%).

“Perhaps now more than ever, consumers need to consider how to protect themselves and their asset if they are able to buy a home in the midst of these economic headwinds,” said Schlichting. "Instead of calling a lawyer after something goes wrong, smart homeowners are starting to get legal advice upfront—before they buy, before they renovate, before problems become expensive disasters."

The LegalShield survey was conducted in May 2025 and surveyed 802 adults, ages 25-80, who live in the United States. The sample was balanced by age, among other demographic variables, according to the U.S. Census.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy and affordable access to legal advice, counsel, protection, and representation. Serving millions, LegalShield is one of the world's largest platforms for legal, identity, and reputation management services protecting individuals and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses, and employers with tools and services needed to affordably live a just and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and transforming how and where people receive legal guidance and services, with access to hundreds of qualified, trusted attorneys and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

Contacts

LegalShield Media Contact:

Hollon Kohtz, Director of Communications

hollonkohtz@pplsi.com